Through the years I have been one of those people that trades vehicles regularly. Used to be I would put on about 50,000 miles in a couple years and trade. I would buy aircraft and put them up for sale when I got home. I also usually paid cash. That’s when planes, cars and motorcycles were still relatively “cheap” to buy.

But look at the vehicle market now. To replace my Jeep Grand Cherokee, the price starts at $40,000 (probably more like high $50’s). A new Harley can cost over $30,000. A new Cessna 172 is $400,000 or more and a used Cherokee 180 can run from $75,000 on up.

Okay, yes, you can find cheaper planes but the idea is that all the prices have gone up. Single-engine prices have been increasing since 2017. The prices for average light, single-engine aircraft have gone up almost 75-80 percent.

But it does seem like it is slowing down. The latest Market Trend Newsletter from VREF Aircraft Value Reference Guide, states that “The single-engine piston market has been relatively steady, although off its highs from the previous year.”

VREF Market Trend also stated that “The market is still active, and aircraft are trading. Interest rates are at play as buyers are more sensitive and able to pay cash if rates are too high.”

Which brings up aircraft financing. Even though the price increases have slowed down, they are still high compared to what they used to be. Not everyone wants to take a few hundred thousand out of their retirement fund to buy an aircraft. Many people are looking at financing an aircraft.

First let’s talk about “term, rates and down payments.”

When borrowing money, you’ll need to decide if a lower payment or shorter repayment length (term) is important. Typically, if you want to keep the payments low, you will be looking at two basic options. You’ll need to come up with a larger down payment of cash or you will have to look for a loan that is based on longer repayment terms. Typically, a down payment of 10 to 20 percent is the average expected. Some lenders look for 25 percent down and if you want even lower payments, all you must do is just dig into your piggy bank and put down a 50 percent down payment.

The terms of the loans can vary. I was given 5 to 20-year terms from different companies. Of course, the longer term was usually for the newer, and higher dollar aircraft. I was surprised that it wasn’t unusual to get a 15-year loan for an older Cessna 172 or Cherokee 140 “category” of aircraft.

You’ll also want to know what additional charges and fees might be included. When you borrow money, some companies have applications fees, “points”, prepayment penalties and more. All of these add to the total cost of the loan. Even though you might get a lower rate, you could end up paying more in payments because of all the extra fees and charges.

When it comes to financing, the bigger the loan amount, the better it is for the “lendee.” Usually, the more money you borrow, the cheaper the money gets. Many of the aircraft finance companies do not like to lend amounts under $50,000 or for aircraft that are over 30 years old. That doesn’t mean you can’t get the money for an old, cheap aircraft like an Aeronca Champ but you’ll probably be better off using the local bank.

Interest Rates

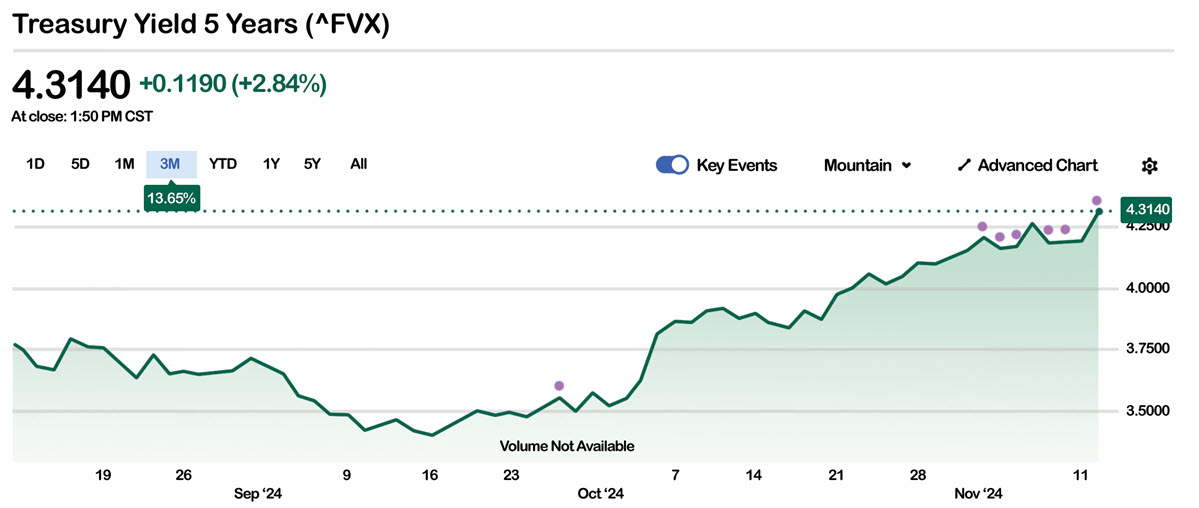

First let me put in my disclaimer. I am not an economist, banker or expert in finance. I’m not sure I can even balance my checkbook. But I do have numerous contacts throughout the industry like Jim Blessing, President at Airfleet Capital (www.airfleetcapital.com).When it comes to interest rates lenders charge, I learned a few things from experts like Blessing. When I watch the news and see that the Federal Reserve is lowering their rates, the first thing I think of is lower rates on my loan. But it looks like a lot of the lending world follows the underlying rates, like the 5-year Treasury.

So, while short-term rates are dropping, long-term rates have been going up since mid-September. Blessing went on to say, “The 5-year Treasury was at 4.31% in early November, and it was below 3.50% in mid-September. That’s 80 basis points increased in the past 45 days. That’s pretty significant!”

So, low Federal Reserve Rates don’t always mean immediately low loan interest rates.

What Do Lenders Look For?

Most compare your income and cash flow to your debt. Other companies use a debt-to-equity ratio only. A few of the companies said they use not only the debt-to-equity ratio but they also use cash flow analysis. Other information is garnered from applications and forms that you fill out for the loan (along with computer check and credit searches). This can take days, especially if you are self-employed, or it can take minutes if you have all your information with you, up to date and organized. And with computers and the internet, many of the lenders can take the basic information over the phone and give you an immediate indication of your “loanability.”

What About the Aircraft?

Loan underwriters will want to see copies of the aircraft logbooks. They want to know the aircraft is in license and flyable. Lenders will also ask for equipment lists and hours of the aircraft, engine and propeller. Some want pictures.

If you are using an “official” aircraft lender, they will require a title search, maybe an escrow account for the money and they will arrange for the bill of sale and registration forms to be signed. The title searches are good for you and the lender. The FAA changes registered owners without any concern for liens or loans that have been filed on the aircraft title. Without a clear title, the lender is not going to give the money to anyone, let alone the seller. And the buyer is taking a big risk buying an aircraft that might still have a lien on the title. Theoretically, the new buyer could be responsible for a loan from the old owner.

What Should You Ask the Lender?

It’s in your best interest to ask the lender a few questions also. A few aircraft lenders are what I would call “loan brokers.” They do all the work to set up the loan, but the loan is with a bank (or several banks) they have an arrangement with.

You should also ask if there are any limits on the age of the aircraft and/or the type of aircraft. A few lenders do not like experimental aircraft. Some do not like turbo props, others only like single-engine, piston-powered planes. Some don’t care. I knew one bank that didn’t finance anything the banker, who was a pilot, couldn’t fly — in case he needed to repossess it.

You can also ask questions about minimum credit scores, hull values and pilot experience. One of my recent insureds had trouble borrowing money for the plane because he wasn’t the pilot.

A Few Things to Do When Looking for a Loan

You’ve probably seen these loan “tips” before, but they are always worth a review. It’s not always possible to find an air craft specific lender. But the following information should be about the same for any lender:

- Choose a finance company or lending source that understands aircraft.

- Select an aircraft that fits your needs financially as well as your pilot skills.

- Review your credit history and make sure all your information is current and correct, PRIOR to applying for a loan.

- Put together a complete financial package which includes: a detailed loan application, up-to-date personal financial statement, at least two years of income verification (w-2, payroll stubs, tax returns and business tax returns if self-employed).

- Provide a thorough description of the aircraft which should include: copies of the logbooks, airframe and engine hours, specification or equipment lists, the result of pre-purchase inspection, and exterior, interior and panel pictures.

- Explanation of how the aircraft will be used, estimated hours of use, location of home base and any other details you can think of.

- Insurance coverage binder and training requirements established by the underwriters.

If you decide to borrow money for your next aircraft, make sure that you are prepared. Following the above guidelines helps to make the process efficient and enjoyable (as enjoyable as borrowing money can be!).