Another Sun ’n Fun has come and gone.. Lakeland is just two hours from my home, so I have never missed one since I moved to Florida in 1997. I used to work the show (and Oshkosh) as an avionics consultant with Eastern Avionics every year from 1997 to 2008, all week long with heavy pressure to sell, sell, sell, resulting in sore ankles and a scratchy throat and yes, a lot of new customers. Now, as a writer, I look forward to “catching up” with the vendors that I have gotten close to and have supported through my articles, and I seek out new products. I try to talk to any vendor in the avionics industry. I’m looking for new products that you might want to know about. Frankly, while I understand, many vendors wait for Oshkosh to announce new products. I found very little “new” at Sun ’n Fun.

This has me asking a question: “What is the current state of the GA avionics market?”

I see a lot of sales activity. Avionics shops are busy, but I see two things happening. First, the used avionics market has very little to offer a legacy aircraft owner trying to do an affordable panel upgrade using good, used avionics. Frankly, this is how owners of legacy aircraft have kept it affordable. And secondly, manufacturers have been quiet with new product introductions in the past five years. Let’s take a look at these two issues, the used market and an overview of the most active manufacturers serving the new avionics market, from the perspective of a guy who owned and flew for over 40 years and who has spent 28 years on the inside.

The Used Avionics Market

When I moved to Florida in 1997, I previously owned six aircraft; starting with a Piper Colt in 1972 and ending with the Cherokee Six I sold in 1992. This was also a period when the avionics industry was flourishing. There were lots of manufacturers and competition was strong. When I started working at Eastern in 1997, the used avionics market was loaded with good used options, Bendix King being the leader in the new market and also dominating used avionics sales. Garmin and UPSAT were just getting started. We made a living on used Bendix King, but none of that equipment is viable today. In fact, most of the manufacturers that offered and supported viable used options in 1997 are gone, leaving all that equipment unsupported and of no value to a pilot on a budget. Let’s take a closer look at the survivors and current leaders in the GA avionics marketplace. In this article we will do an overview of the big-name manufacturers with broader products targeting the GA market today (in alphabetical order). Next month, we will talk about the “specialists.”

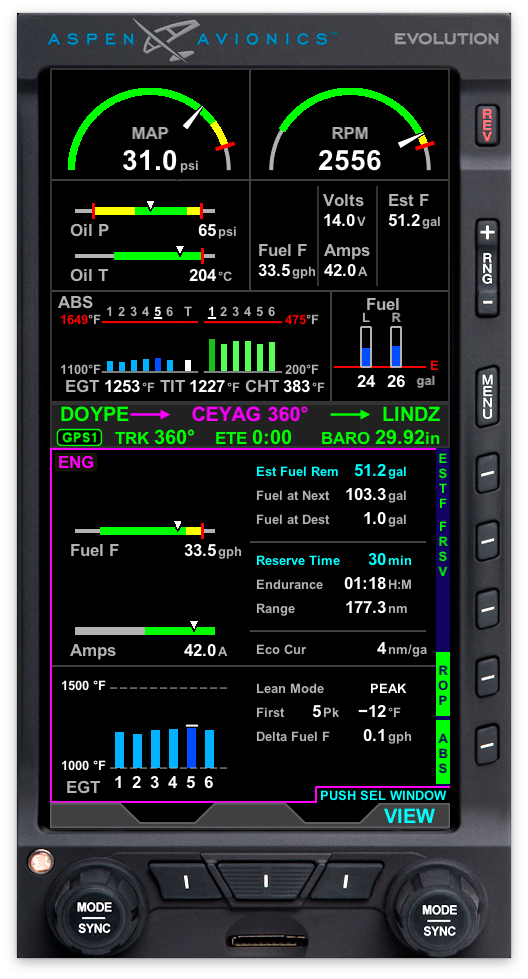

Aspen Avionics

Aspen was an early innovator when they introduced their EFD-1000 Primary Flight Display in 2008. You could add solid state AI and HSI, while eliminating the vacuum system, all without cutting a new panel. They’ve continually upgraded their equipment and eventually introduced the Aspen E5 as a more affordable PFD option. If you have a good working legacy autopilot, Aspen can interface to it. In fact, they have special interfaces available for the Genesys/S-TEC autopilots and now the Trig Pro Pilot. If you want to interface your legacy autopilot to a modern EFIS PFD, Aspen has more options. I was told at Sun ‘n Fun that Aspen is in the process of adding engine monitoring capability to the EFD’s, but they are waiting on certification.

Avidyne Avionics

I’ve mentioned the phases the industry has gone through in previous articles. Today, we are in the EFIS phase, but back in 1997, the MFD or Multi-Function-Display phase was just beginning and Avidyne was an innovator with FSD (Flight Situation Displays), as they were called. Pilots were able to add panel-installed mapping and charts so they could ditch their old black and white radar displays for a modern, color display that also displayed flight information. Today, Avidyne offers a full line of avionics from audio panels to Mode S.

However, the introduction of the IFD integrated navigator in 2014 is what really put Avidyne on the map. The decision to make the IFD440, or large format IFD540 and 550 (with ARS and optional synthetic vision), a slide-in replacement for Garmin GNS series navigators was brilliant! Simply stated, if you are about to upgrade a Garmin GNS navigator, you save about $5,000 in installation and connectivity costs with the Avidyne, versus upgrading to the Garmin GTN series.

In addition, Avidyne still offers a very good, active traffic solution, and has been the source for panel upgrades for the popular Cirrus brand. As thousands of Garmin GNS navigators reach their useful end, Avidyne is perfectly situated to benefit. Therefore, I expect big things from Avidyne to continue.

Dynon Avionics

Dynon entered the avionics market in 2003 with the introduction of the EFIS-D10 unit for the experimental and light sport market. Jump thirteen years and Dynon’s Skyview HDX big screen (10″) option became available for experimental/light sport. In 2018, the Skyview HDX got full FAA certification and is now available for installation in nearly 800 certified aircraft models. At the time, the Garmin G500 EFIS system was the only option for a certified aircraft owner to add big screen EFIS. Dynon went on to add engine monitoring and a full-featured two-axis autopilot to the system. In short, and I have repeated this many times in my articles and to my clients, if you are in the market for big screen EFIS, primary engine management, and a full featured and integrated, two-axis autopilot, then Dynon is a value leader.

I estimate the Dynon HDX system fully installed in a Cessna 182 or Piper Archer to be about $45,000 plus about $5,000 for a new panel. One thing that may have been holding Dynon back a bit was the speed in which they were adding STC’s for their autopilot. Autopilot manufacturers pursue STC’s based on return on investment. Notice there are no STC’s that I know about for the Aircoupe! This often means that many popular legacy airframes are low priority for STC’s. Dynon and Trio came up with a brilliant solution. They created an interface for the Trio Pro Pilot autopilot and are now co-marketing the Dynon HDX with the Trio Pro Pilot. This just added a ton of legacy models to Dynon’s EFIS market! In addition, show Dynon that you have a qualified mechanic and IA to sign off and you may be able to avoid the backlog we are seeing at avionics shops. If I am right and we are in the EFIS phase, then Dynon is in the right place at the right time with the right product!

Have a website login already? Log in and start reading now.

Never created a website login before? Find your Customer Number (it’s on your mailing label) and register here.

JOIN HERE

Still have questions? Contact us here.